Do the parties have to be separated for property settlement to work?

Yes, separation and property settlement are closely connected, as explained in our other editorials. In reality, parties have to be separated in order to be able to enter into a property settlement agreement, whether separated by choice or by circumstances.Does property settlement work only in divorce?

You do not have to wait until you are divorced for property settlement to take place. As explained in our other editorial, divorce is not a condition for property settlement agreements to be in force, and the main relevance of divorce is limitation periods for bringing certain claims. Parties can finalise their property settlement and divorce later.Who prepares the property settlement agreement?

Property settlement agreements can be prepared by family lawyers by way of binding financial agreements or through the Family Courts by way of consent orders.Which property is included in the asset pool for property settlement?

The answer is pretty simple – all property of the parties, regardless of whether they are registered under the name of one of the parties, both of them, a company controlled by any of them or even under a trust, as long as one of the parties controls that trust. Even if the property was owned by a party prior to commencement of relationship, it will still be included in the matrimonial asset pool. It may affect the final percentage of the property split/distribution, but it is included in the calculation.There are also circumstances when property is not directly under the name of the parties or their legal entities, but is under their control, and therefore is considered in the property settlement.

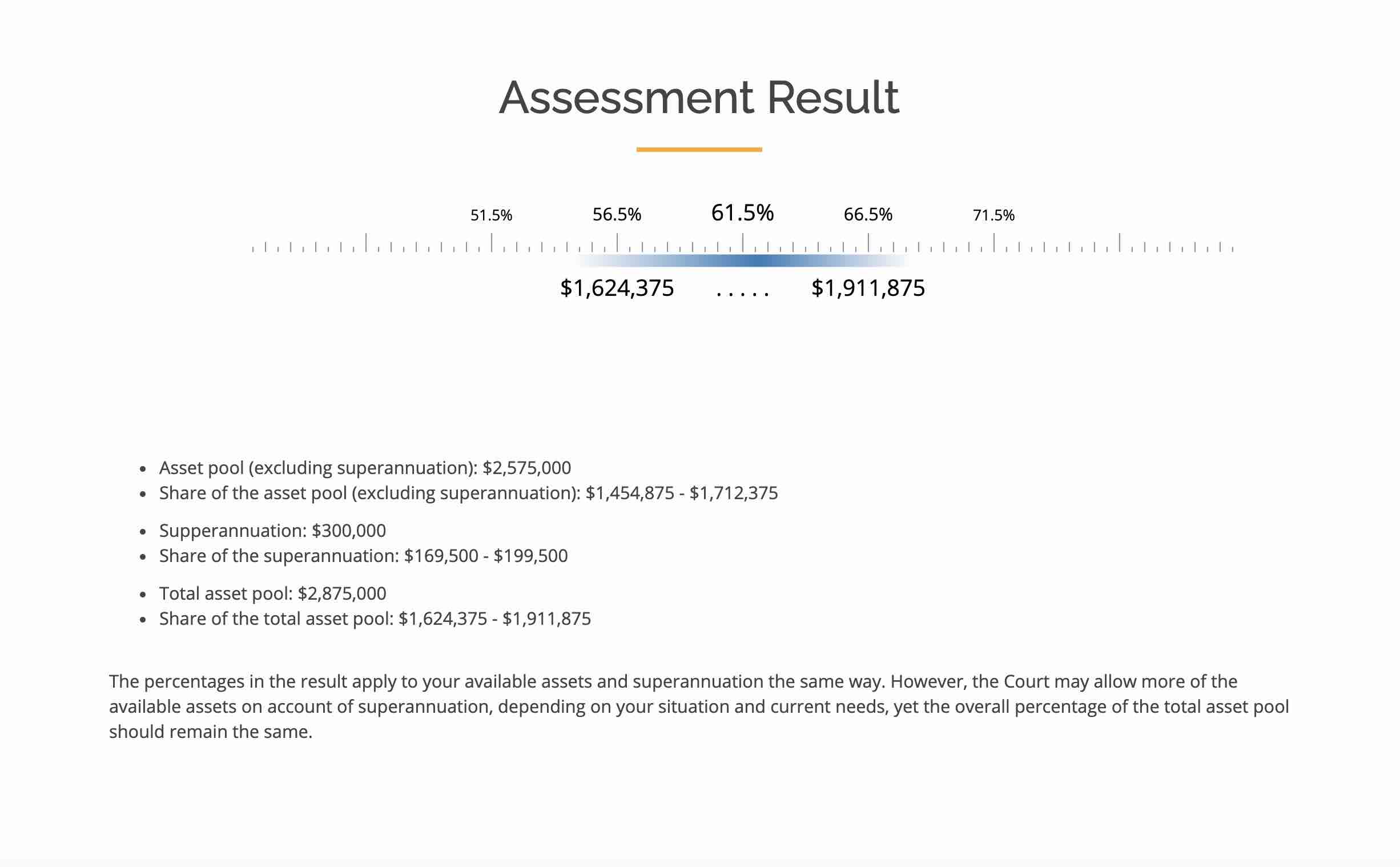

Who gets what? How are the assets divided between the parties?

Once all properties and their values are determined, the parties’ family lawyers and/or the Family Courts if applicable, will consider what kind of property settlement or split/distribution is fair and reasonable in the circumstances. There is no such thing of ‘maximum share’ or ‘minimum share’ which is possible in a property settlement. Each case is judged by its circumstances, and cases can end up without any property division if it is unjust to do so, or with a property division/split of 90/10 (in extreme cases), 50/50, 70/30 or any other combination possible.As to who gets what, there is no guarantee that one party will be allowed to keep a specific asset on account of their share in the property settlement. When circumstances allow, Courts would usually try to allow parties to keep their businesses, residential premises and other assets, as long as any necessary division can still be made from the other assets.

Does property settlement work for superannuation?

The parties’ superannuation is included as part of the matrimonial asset pool and so you are entitled to a share in your partner’s superannuation just like they are entitled to yours. Adjustment may have to be made between the superannuation funds.Again, you do not have to be divorced to be entitled to a superannuation split as part of the property settlement.

Superannuation funds usually have a death nomination clause in which the member nominates the beneficiary of the funds in case of death. These nominations are usually updated every few years. You need to remember to change those nominations if you do not want your partner to remain the entitled person. These nominations, at times, simply refer to your ‘legal beneficiaries’ which means whoever is entitled to your property after your death will be the beneficiary of the superannuation as well. It is therefore recommended to write or change your will to make sure you nominate your preferred beneficiaries, and not leave the situation open for interpretation or dispute, especially if you are not divorced at the time of death.